The creation of a new index to track and invest in the fast growing technology stocks on the Australian Securities Exchange will help boost the number

of tech IPOs locally in 2020, experts say, as new figures show the number and value of ASX listings fell in 2019.

On Monday, the ASX revealed plans to create a Nasdaq-style S&P/ASX All Technology index from February, and executive general manager of listings and

issuer services, Max Cunningham, said it would push new companies to a pipeline of listings next year, which already looked like outstripping 2019.

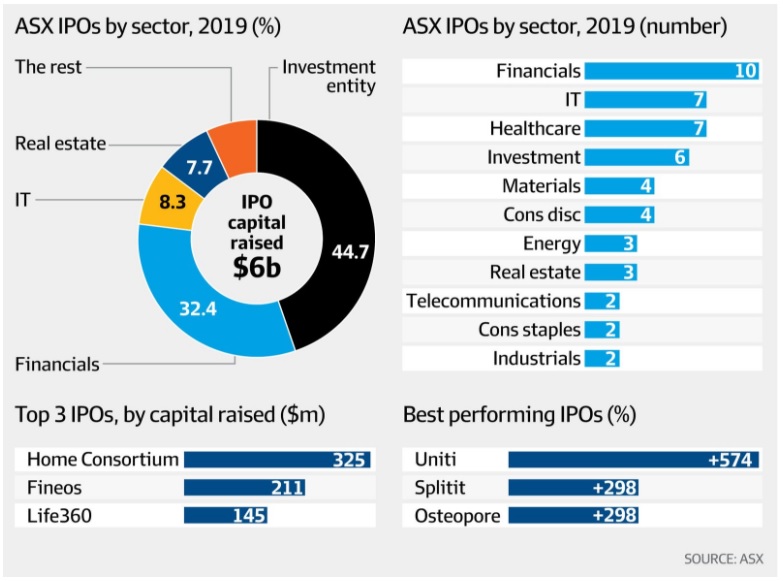

Despite the number of IPOs being down on 2018 both locally and globally, tech stocks represented the highest number of new listings on the ASX. In total,

90 new stocks are expected to have listed by the end of 2019.

"This is always caveated with volatility in markets, but we've probably never had a better [tech] pipeline,'' Mr Cunningham said. "Next year looks big

in terms of size, and also the number of tech companies, which has been coming in at around 12 to 15 each year ... we may have a few more next year."

Figures compiled by the ASX show the local IPO market was down 21 per cent in terms of capital raised in 2019, from $8.5 billion to $6.7 billion as at

December 12. Dealogic data, meanwhile, showed that the global IPO market was down 12 per cent year-on-year.

While the ASX's push is still small in comparison with the Nasdaq's dominance of global tech listings, Mr Cunningham said US exchanges had been heavily

focused on tech for 30 years, in comparison to five years at the ASX.

He said Australian tech stocks were more heavily weighted towards business-to-business companies such as WiseTech and Xero than the US boards, where big

consumer brand names including Facebook and Apple were traded, but there was huge potential for it to grow along with the local tech sector.

"I think the important distinction is we are bringing companies to market earlier than US IPOs, which means earlier access to institutional investors and

bringing more diversity to investors," Mr Cunningham said.

"Tech is 20 per cent of the S&P 500, whereas IT currently makes up just 6 per cent of the ASX 200 index by number of companies, and only 2.5 per cent

by market cap."

Reaction to the announcement of the new tech stock index was largely positive, but analysts were divided about its potential to drive a larger locally

listed tech sector.

Mark Bryan, the head of research at Wilsons, said it was a strategically sound initiative that would raise visibility in the domestic sector while providing

investors with more options.

"Over the last decade we have experienced an infusion of high quality tech plays on to the ASX,'' he said. "Any initiatives to further raise visibility

and cement the ASX as a leading global exchange for small- to mid-cap technology names is a positive."

Mr Bryan said companies included on the index could experience a "network effect", and benefit from being classified alongside well-established tech companies

such as Xero, Bravura and TechnologyOne.

However, senior technology equities analyst at Morningstar, Gareth James, said he doubted an index would overcome Australia's disadvantage of being so

far away from large investor bases in the US and Europe.

Big challenge

"Considering the size and composition of Australia’s economy and population, it’s unlikely that Australia will ever be a material source of technology

companies from a global perspective," he said.

"For most overseas companies, there's little logic in listing in such a remote region unless they are so small and so early stage that they are unable

to list elsewhere in the world.

"However, this creates the issue for the ASX that they risk attracting small and high-risk companies, which kind of defeats the logic of what they are

trying to achieve."

Hugh Bickerstaff, the global chief investment officer at angel investor group Investible, was more positive about the long-term potential of the local

tech industry.

He said the new tech index represented a natural progression in the ecosystem and was recognition of the increasing strength and maturity of local entrepreneurs

and investors.

It would allow Australian tech founders to access larger pools of capital earlier and from a much broader investor base.

"Retail investors will also be able to access and support Australian tech companies in a more liquid fashion," Mr Bickerstaff said.

"This will encourage early stage investors to support Australian tech startups, as there will potentially be a new pathway to liquidity in early stage

investing. And these events will be able to occur earlier due to the lower thresholds."

The general manager of industry group FinTech Australia, Rebecca Schot-Guppy, said the AllTech Index represented a good first step towards highlighting

the success of listed technology companies in Australia to the broader investment community.

"Work will have to go into promoting this index, as the market by default will still focus on the ASX 100 and its top 20 companies. Hopefully, the performance

of its companies will turn heads," she said.

"Over time, it would be interesting to see this index narrowed even further into categories of technology, like fintech. Technology is ubiquitous and leveraged

in every new company, so even the phrase ‘technology company’ could become redundant over the next decade."

Co-founder of video technology startup Shootsta, Tim Moylan, said going public remained a complex process for emerging companies, but he believed the profile

and credibility offered to companies able to make the ASX's new index would encourage some to investigate their options.

"It’s a badge of honour and credibility to be part of the ASX 100, so if the ASX creates a similar but smaller list for top technology companies on this

index and promotes it, then it could encourage more technology companies to list locally instead of overseas," he said.

"It could also encourage them to dual-list and get exposure to a larger market, but also the benefit of being able to promote their top position on the

ASX."

Source: Finanical Review

WHY NOVUS CAPITAL?

WHY NOVUS CAPITAL?